Warner Bros Discovery: Is it a buy? Diving into the valuation and business fundamentals

Subscribe to my newsletter for contrarian stock picks and deep dives into the fundamentals

Warner Bros. Discovery (WBD) remains a controversial stock, with the merger integration still facing scrutiny from some investors. However, my thesis is that if we look past the noise and focus on the fundamentals, there is an opportunity here for significant upside over the next 2-3 years.

My time horizon for WBD is at least two years, and I plan to hold through 2025. At current prices, WBD needs to deliver on two key fronts: paying down debt and aggressively cutting costs to reach profitability in the streaming and studios business. WBD does not need to "win" streaming to reward investors - simply improving free cash flow generation is enough.

Paying Down Debt

Management has clearly stated a goal of reaching investment grade status and 2.5-3x gross leverage by the end of 2024. So far, they have aggressively paid down debt, reducing total debt by over $9 billion since the merger. Q2 2022 saw another $1.6 billion in debt repayment.

With most debt at low fixed rates and staggered maturities, refinancing risk appears low. Debt reduction should allow multiple expansions as perceived "risk" declines. On top of that, there should be an increase in free cash flow as interest payments on debt decline. Here you can see how the total debt has declined over the last few quarters:

Improving Profitability

WBD has focused intently on cutting costs and finding synergies between the merged companies. Over $4 billion in total synergies have already been identified, and it can go up to $5 billion by 2024. Streaming is approaching breakeven faster than expected, with global DTC roughly breakeven in Q2 and U.S. streaming generating healthy EBITDA. These efforts are critical to offsetting linear declines and maintaining free cash flow.

Ad sales remain challenging but showed modest improvements in Q2 and Q3. This area remains uncertain, but some optimistic signs are emerging. Overall, the company seems to be making good progress on its profitability goals, especially on the streaming side.

Here you can see over the last few quarters the operating income (loss) is also improving, however you can see an uptick in the last quarter which is mainly due to the fact that a lot of expenses for Barbie were recognized a quarter earlier, and in the next quarter you can expect this number to improve further:

Valuation

The best way to value WBD is using Free Cash Flow. I am calculating FCF by using the following formula:

FCF = Cash From Operations - CapEx

And FCF Yield as,

FCF Yield (Market Cap) = FCF / Market CapFCF Yied (Enterprise Value) = FCF / EV

And if I compare the valuation of WBD with Disney and Netflix I get the following results:

You can see that WBD is extremely undervalued compared to Disney and Netflix and it is trading an FCF Yield (MarketCap) of 13%, now one might argue that the main reason WBD trades at a steep discount is because it has a lot more leverage, therefore, the market is demanding a higher return but we can also see that even when we take debt into account and calculate FCF Yield with respect to enterprise value it seems that WBD still trades at a much higher discount.

All of this data points in the direction that there is too much negative sentiment about WBD and the market has clearly oversold this stock. Even if we assume that WBD does absolutely nothing to grow revenues in the next two years and just focus on paying down debt and focusing on profitability the price will eventually reflect the underlying value and the contrarian investors who take this bet now can massively profit from this

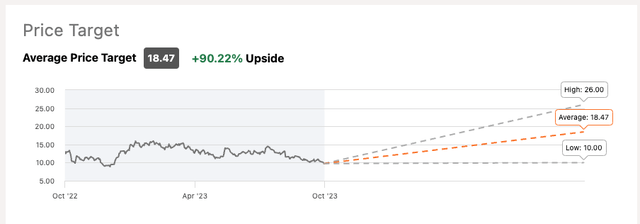

Price Target

Looking at the analyst price target it seems that the average expected price target for WBD is around $18.5 meaning that there roughly a 90% potential upside if our thesis plays out well

Based on seeking alpha peer comparison WBD trades roughly at 11 EV/EBITDA while Disney trades as 15 and Netflix at 29 EV/EBITDA

Based on this we can attempt to calculate the 2025 price target for WBD with the following very conservative assumptions

- I expect the 2025 Net Debt to be around 38B down from the current 44B (so the expectation is they pay down 6B in the next two years)

- In 2025 I expected WBD to trade at 15 times EV/EBITDA (same as Disney is trading now) up from 11 times EV/EBITDA

- In 2025 I expect no growth in EBITDA and expect it to be the same as it is now which is 6.1B

- In 2025 I expect the total shares outstanding to be 2,4B same as right now (I am assuming no dilution)

Then based on the above assumption we can come up with the price target as follows:

It gives us a rough price target of $22 per share which is in line with the upper range of analyst 1 year price target

Key Risks

Execution risk remains high, and streaming/studio turnarounds may take longer than expected. The fast decline in their linear business remains a challenge. Debt paydown is reliant on maintaining free cash flow. Any economic downturn in 2024 could impact efforts on both fronts.

Conclusion

Despite valid concerns, WBD is delivering on its fundamentals of debt reduction and cost-cutting. The management team is laser-focused on these goals. While risks remain, patient investors could see a significant upside over the next 2-3 years as the merger integration progresses and streaming trends toward profitability. I believe the current stock price does not fully reflect the potential for fundamental improvement. I would end this article with the following questions:

Do you see the business fundamentals improving over the next two years?

Do you believe that the expected improvement in business fundamentals is not fully priced in?

If the answer to both questions above is yes, you can consider investing in WBD otherwise stay away from the stock.